- Address the growing evidence gap in the high-stakes business of real estate investment, development, marketing and management;

- Meet increasing market demand for the Company’s proprietary research models and analytics; and

- Deliver such insights faster and at a lower cost basis than bespoke research projects.

Sign up to receive updates, news and more.

Delivering Demand-Side Business Intelligence for the Built World.

What is RCKRBX?

FROM GOLD TO DATA:

Actionable Intelligence is Today’s New Currency

A “rockerbox” is a 19th century mining implement used for separating gold from gravel.

RCKRBX™ is a 21st century business intelligence platform for assessing markets, evaluating investment potential, and optimizing the programming, positioning and performance of multifamily real estate assets.

Award-Winning Technology

What If?

What If?

- You could spot market shifts before your competition and place capital where returns will outperform?

- You could accurately predict renter demand and competitive performance before you buy or build?

- You could drive faster lease-ups and higher rents by understanding who your high-propensity renters are, where they are, what they want, and how much they will pay for it?

How might such leading insights impact your decision-making as properties are acquired, developed/repositioned, marketed for lease-up, and managed over time?

What We Do

THE DIFFERENCE BETWEEN THINKING AND KNOWING.

The Difference Between Thinking & Knowing.

RCKRBX™ is the first SaaS data platform to deliver leading-indicator insights and predictive business intelligence for the built world.

Platform harnesses proprietary data science, machine learning and probability-driven analytics to:

- Deliver actionable insight around the preferences, priorities, attitudes, and viewpoints that drive renter demand and decision-making;

- Predict how these factors will shape markets over time and impact asset NOI, competitive performance, and liquidity/returns; and

- Enhance decision-making capability and confidence across the asset lifecycle

Turn Questions

Into Answers.

Assess Markets and Investment Opportunity

Want to spot the next market shift before your competitors do?

Compare and contrast renter demand across markets, asset/unit types, and population segments/demographics to assess product-market fitness and feasibility. Track early market trends, shifts in renter preferences, and impact on demand, absorption, and premiums. Index renter demand vs. unit supply vs. rent premiums to assess product saturation levels, uncover future need, and evaluate investment performance potential.

Identify, size and prioritize the prospective renter populations most likely to consider and choose your project. Understand who they are, when they will be in-market, how they differ from other renters, what they value most, what they are looking for in their next live-space, and to what extent these factors influence their decision-making around where they choose to live, what they choose to live in, and how much they will pay for it.

Characterize ideal neighborhood feel, desired area programming, and highest-demand elements by proximity to the project site as well as ratings of locational attributes (e.g., crime, school quality, transportation, walkability, etc.) relative to renter decision-criteria.

Optimize Project Programming and Positioning

Is your project aligned with what renters want (and will pay for)?

Understand programming preferences and live-space priorities of your target renter populations as well as how such decision-criteria influence their property selection / lease likelihoods. Use these leading indicators to: (1) stress-test acquisition and/or development theses against actual market appetite relative to supply; and (2) align project programming (unit mix, finishes, features and amenities) with target audience demand and premium drivers.

Accurately Forecast Project Performance

Want to know how your project will perform—before you buy/build?

Quantitatively evaluate project feasibility and fitness, identify the ideal risk-return balance down to the unit and audience levels, optimize proposed mix and project programming (relative to renter demand and population densities) to maximize returns, and accurately predict on-market asset performance.

Accelerate Lease-Up and Maximize Marketing ROI

How can you turn better targeting into faster lease-ups and higher returns?

Know who your high-propensity and premium-paying renters are (target audiences) based on projected capture rates/lease-up contribution. See where they are, what they look like (personas), what product/unit types they are looking for, what property attributes matter most to them, and how these factors impact their leasing decisions. Learn what to say to them (messaging), where (channels), when (sequencing), and how (tactics) based on their information consumption habits and what they value.

What Our Clients Say

“Real estate development and its investment remains one of the few industries that regularly fails to use consumer research as a key input. RCKRBX delivers demand-side insights which create guardrails for smarter investment strategies and tactical decision-making around renter preferences.”

Lisa Picard

Managing Director, OxygenRE and Former CEO of Blackstone’s Investment Platform (EQ Office)

“RCKRBX greatly enhances our ability to pressure-test investment theses, optimize project positioning, and capture higher returns for delivering the right asset, in the right place, to the right audiences.”

Mark Taylor

Managing Director-Residential, American Real Estate Partners (AREP)

“In today’s economic landscape, it is imperative to go beyond traditional market studies and methodically assess opportunities with a forward-thinking, consumer-centric approach. We believe the intelligence RCKRBX offers provides the degree of clarity and confidence to successfully position projects for the future and optimize investment outcomes.”

Noel Bejarano

CEO, Camino Capital Management

“In commercial real estate, the most widely used data either tells you “what happened” or provides context for “what’s happening today”. RCKRBX enables us to see “what’s next” to successfully position projects for the future and optimize investment outcomes.”

Evan Regan-Levine

Chief Strategy Officer, JBG SMITH

“In my opinion, RCKRBX will become the gold-standard for demand-side data in the industry—whether evaluating investment opportunities or determining unit mix, amenity programming and pricing or positioning a project for lease-up—no other platform delivers this level of precision, granularity and insight.”

Michael E. Muldowney

Executive Vice President, CBRE | Capital Markets

“We are always looking for innovative solutions to enhance the performance of our communities. With RCKRBX, we gain access to extensive data that empowers us to closely examine the priorities of potential residents and create communities that cater to their preferences and demand drivers.”

Mollie Fadule

Chief Financial and Investment Officer, JPI

What We Offer

Platform Subscription and Enterprise SaaS

RCKRBX PLATFORM SUBSCRIPTION

RCKRBX offers a flexible, modular subscription structure that allows users to tailor platform access to their specific evaluation needs. Every subscription includes access to the Renter Segmentation module, providing a foundational understanding of target renter audiences—who they are, what they value, and how they make leasing decisions. From there, users can select any combination of additional data modules to activate, based on their role, project stage and/or strategic priorities.

This model provides maximum user flexibility and cost-effectiveness, delivering the insights that matter most at each stage of the project lifecycle.

ENTERPRISE SaaS DEPLOYMENTS

Enterprise SaaS deployments integrate RCKRBX proprietary data, machine learning algorithms and predictive analytics; internal data from the organization; project and portfolio specific data; contextual market information; and custom interface configurations with user-level dashboards and reporting capabilities.

Reports and Custom Research

REPORTS

MARKET-LEVEL DEMAND LANDSCAPE:

Enables organizations to assess/compare markets and investment potential; characterize the renter landscape, identify renter demand, unmet/future product needs, and programming preference trends; forecast market movement by leasing decision horizons 36 months into the future; and assess market appetite/performance potential based on unit supply vs. renter demand and achievable premiums.

PROJECT-LEVEL EVALUATION AND PERFORMANCE OPTIMIZATION:

Provides a detailed, demand-side evaluation and performance analysis for a potential acquisition or development project within a specific market/geography. Enables an organization to assess investment risk-return down to the unit and audience level, stress-test development assumptions, align asset programming with renter demand and premium drivers vs. existing supply to optimize project positioning and on-market performance (lease pace and premiums).

RENTER MICRO-TARGETING AND LEASE-UP ACCELERATOR:

Provides a detailed analysis of the overall renter universe for a specific asset and identifies, sizes and prioritizes the renter populations most likely to consider and choose the property. Renter targeting includes: (1) geo-demographic and psychographic persona segmentations and lease-up contributions; (2) mapping of zip codes with the highest concentrations of target renters; (3) demand drivers and decision-criteria (unit type, finishes, features, amenities, etc.); (4) lease time horizons, rent budgets and demand depth by unit type; (5) top-performing messaging thematics; and (6) renter information consumption habits (to guide media mix/marketing tactics).

CUSTOM RESEARCH

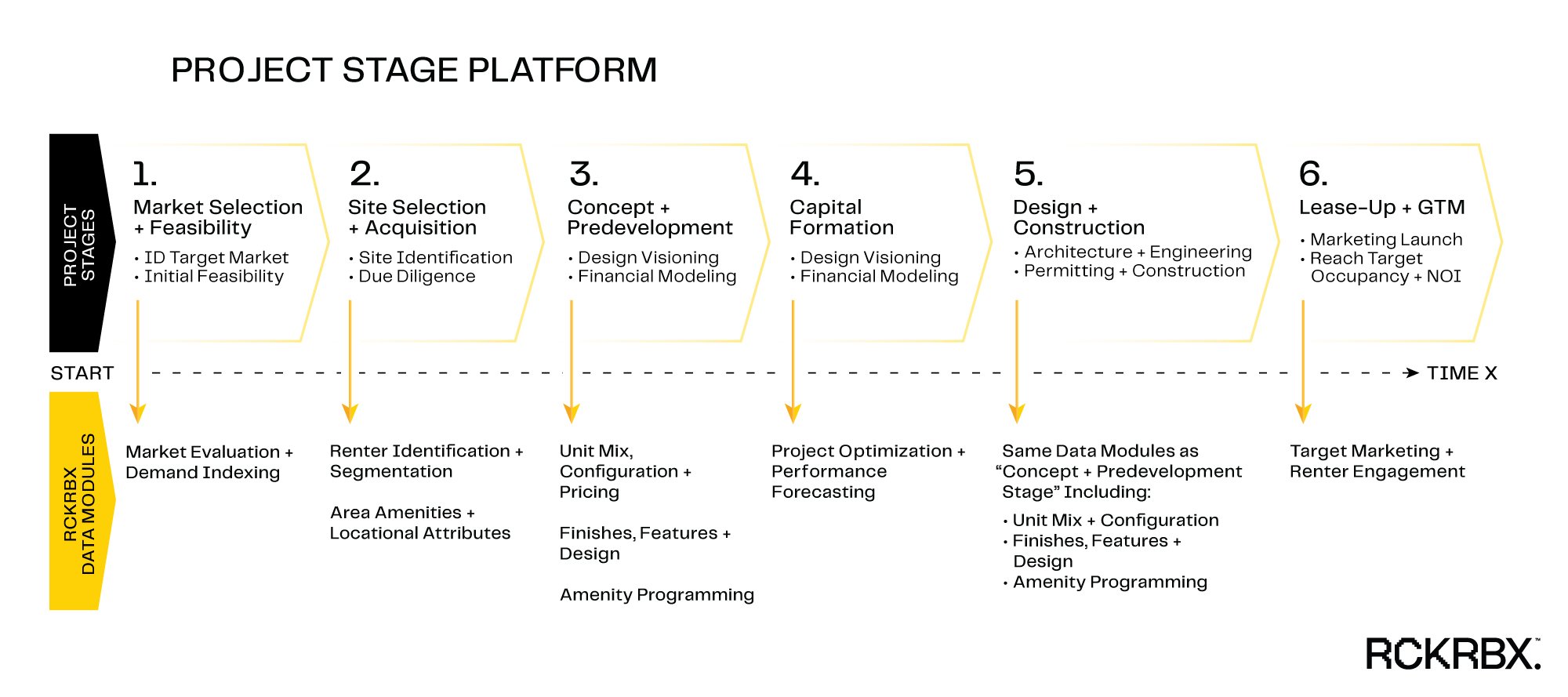

Platform Modules Align to Specific Project Stages

Market Selection + Feasibility

Market Evaluation + Demand Indexing

Assess product-market fitness and feasibility. Identify and track early market trends and future impacts on occupancy and premiums. Index renter demand vs. unit supply vs. achievable premiums by asset class, unit type and population segments to gauge saturation levels, unmet needs and investment opportunities.

Site Selection + Acquisition

Renter Identification + Segmentation

Identify who your target renters are, what matters most to them (decision-criteria), what they are looking for (demand drivers), and how to prioritize by lease up contribution.

Area Amenities + Locational Attributes

Characterize ideal neighborhood feel and demand for desired area programming by proximity to the project site as well as ratings of locational attributes (e.g., crime, schools, walkability, etc.) relative to renter decision-criteria.

Concept + Predevelopment

Unit Mix, Configuration, + Pricing

Understand renter demand by unit type, configuration preferences and rent premiums vs. existing supply to properly allocate mix.

Finishes, Features + Design

Align project finishes, features and design with target audience demand drivers. Understand how these preferences influence property consideration, lease likelihoods, and rent premiums.

Amenity Programming

Measure amenity preference and performance. Rank 80+ amenities (including desired placement) by renter demand and impact on rent premiums.

Capital Formation

Project Optimization + Performance Forecasting

Quantitatively evaluate project feasibility, identify the ideal risk-return balance down to the unit and audience levels, optimize project mix/programming to maximize alpha (premiums and returns), and accurately predict on-market asset performance.

Design + Construction

Unit Mix + Configuration

Understand renter demand by unit type, configuration preferences and rent premiums vs. existing supply to properly allocate mix.

Finishes, Features + Design

Align project finishes, features and design with target audience demand drivers. Understand how these preferences influence property consideration, lease likelihoods, and rent premiums.

Amenity Programming

Measure amenity preference and performance. Rank 80+ amenities (including desired placement) by renter demand and impact on rent premiums.

Lease-Up + GTM

Target Marketing + Renter Engagement

Increase lead-to-lease conversions, shorten time-to-stabilization and drive greater performance by knowing who your high-propensity renters are, where they are, what they look like, what they are looking for, what product attributes matter most to them, what to say to them, and how to effectively reach them (based on their information consumption habits).

*Note, contact details required for download

Download:

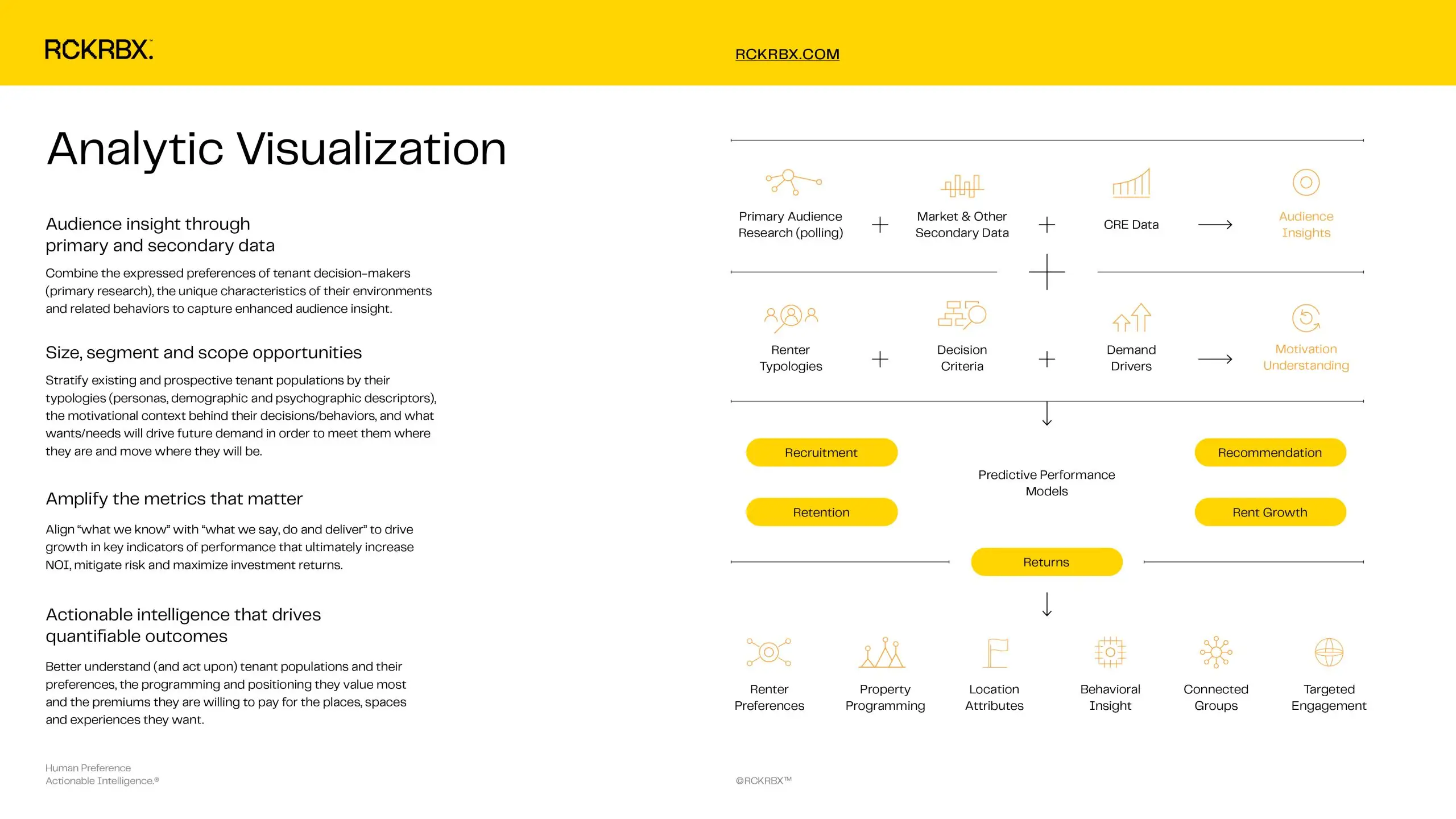

Analytic Visulization

The value of place is determined by the people who desire it and what they’ll pay; not by comps or past market performance.

Michael Broder

CEO, RCKRBX

Why We Exist

A New Era Demands

New Thinking.

For years, the commercial real estate industry has relied on backward-looking data to inform forward-looking decisions. And what happened? Hyper product commoditization…price and concession-driven rental markets…misaligned supply vs. actual market demand…and growing numbers of underperforming assets.

RCKRBX now makes it possible to paint far more holistic, accurate, and predictive pictures of a project’s future, the populations who will live there, and the premiums they will pay for what and why.

Turn leading indicator data into actionable decision intelligence.

Translate complex insights into clear, high-value investment, development and leasing strategies

Anticipate market shifts.

Predict renter demand, market trends, competitive pressures and performance impacts before they happen

Place capital with precision.

Position assets and investments where returns will outperform before the market responds

Outpace the competition.

Claim first-mover ground and proactively adapt projects/properties to modern renter wants and needs

See what others miss.

Position assets exactly where, when and why demand is forming

*Note, contact details required for download

Download:

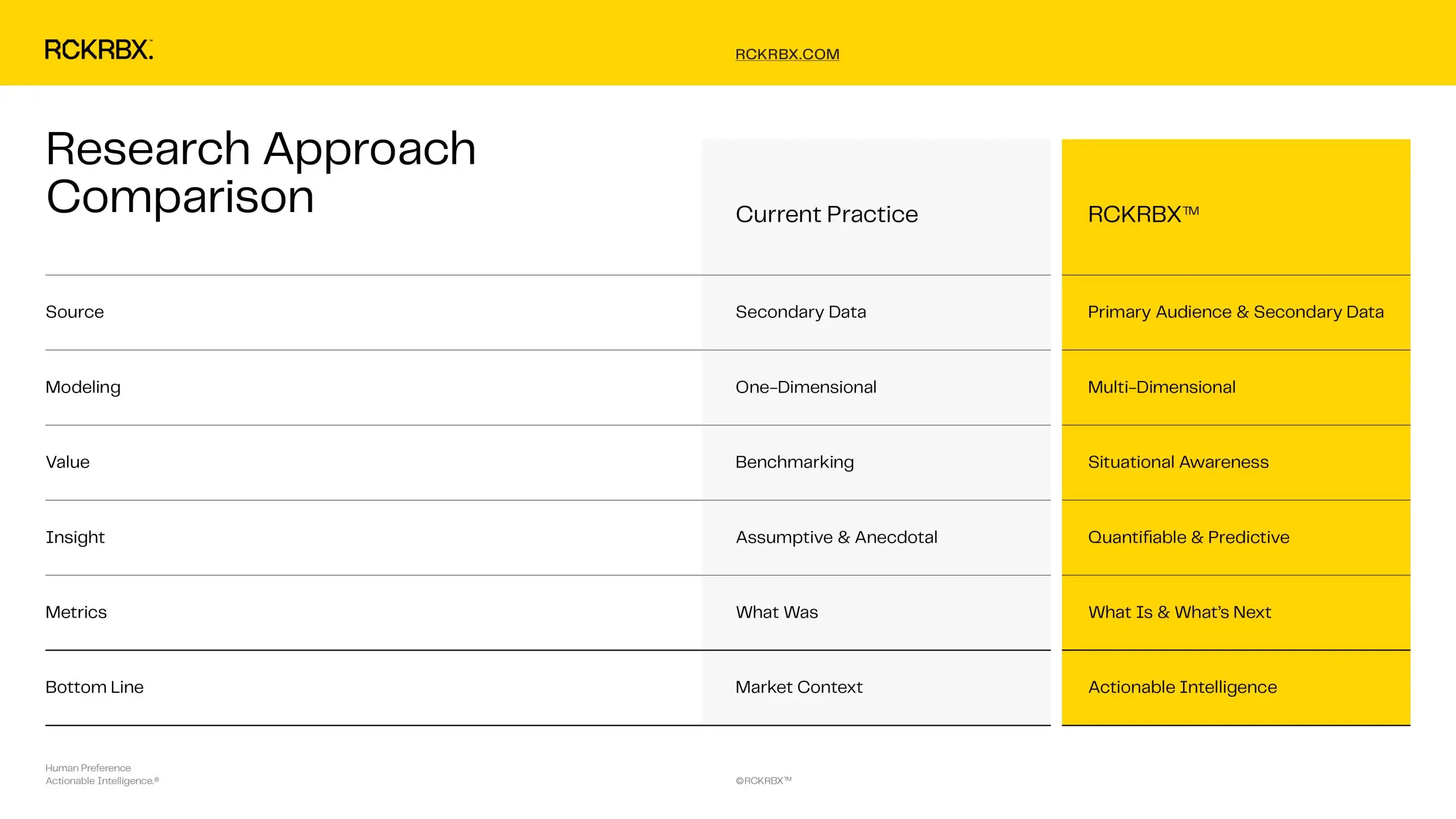

Research Approach Comparison

Most firms analyze the past. We believe you should see the future.

Kevin Hudak

Chief Research Officer, RCKRBX

RCKRBX™ Data Model

Knowing “what happened” in a market or comp set is useful context but such information lacks causation—the critical consumer connections to understand:

- “the why” (market forces driving change/outcomes);

- “what’s next” (future product needs/opportunity); and

- “how to capitalize on it” (investment alpha).

RCKRBX’s machine learning algorithms and probability-driven analytics combine millions of renter polling data points (demand-side) with contextual market information (supply-side) to unlock market opportunity, predict renter decision-making, identify drivers of demand and premiums, forecast asset performance, and quantify the value of place.

RCKRBX™ Data Model

The RCKRBX data model was born from the science and discipline of political campaign research and refined over 15+ years of fielding custom research studies across commercial office, multifamily and mixed-use sectors.

• Proprietary polling database (demand-side) is updated quarterly and includes statistically powered and representative survey samples for each market/zip-code mapped to census geo-demographics

• Secondary market information (supply-side) ingested into the platform is drawn from diverse sources including: Census, Moody’s, Bureau of Labor Statistics, MapBox, Spatial.AI, and others

RCKRBX™ Data Model

Primary Audience Research (demand-side data) is derived from specific populations and their preferences, attitudes and behaviors.

It provides a quantifiable look into what is likely to happen based on what individuals say about particular desires, expectations and intentions.

Primary audience insights are the purest form of actionable intelligence—particularly when used to predict market movement, extract critical insights from contextual big data, and properly account for the various factors impacting asset performance.

RCKRBX™ Data Model

Secondary Market Data (supply-side data) is mined for broad product and/or population trends, comparative benchmarking, etc. and suggests likelihoods based on the assumption that “what has been” will “continue to be”. But, of course, things change.

The real value of secondary market data is the history and context it provides.

RCKRBX™ Data Model

RCKRBX’s Analytics focus on understanding “the why” at the intersection of demand and supply data to inform “the how” and “what’s next”.

The goodness from each data set complements the other and, together, provide a far more rich, true and complete understanding of “what actually is” and “what ought to be”.

What We Deliver

Big Insights.

Bigger Outcomes.

- More accurately predict investment opportunities with outsized performance potential and design new market-entry strategies;

- Gain a holistic look at the way populations, assets and markets will perform over time and why;

- Model investment risk-reward probabilities down to the unit/audience level and stress-test underwriting assumptions against actual market appetite (renter demand and achievable premiums by unit and product type);

- Optimize asset programming, positioning and performance around who your high-propensity renters are, where they are, what matters most to them, and how much they will pay, for what and why; and

- Increase marketing ROI (lead-gen, lead-to-lease conversion rates, etc.), shorten time-to-stabilization, and drive greater premium capture/competitive performance.

RCKRBX Products

RCKRBX SUBSCRIPTION LEVELS:

RCKRBX™ was born from the science and discipline of political campaign research and we seek to leverage renter insights to democratize real estate development.

James Moore

COO, RCKRBX

Who We Are

Our Background

FIRST POLITICS. NOW REAL ESTATE. ALWAYS DATA.

RCKRBX was founded in 2020 by the principals of Brightline Strategies, a leading research and advisory services firm.

For more than 20 years, Brightline helped some of the most recognized names (and many other “up and comers”) shape their business strategies, mitigate risk, maximize asset value and returns, and expand portfolios across markets and borders.

Past engagements span a diverse client base including technology, life science, energy, sports, real estate, banking, professional services and non-profits. This diversity ensured every client benefited from the cross-pollination of our lessons learned and results achieved.

Our Philosophy

We believe real estate assets are candidates and every day is election day. Each day, prospects vote with their preferences. Renters with a “like” or “retweet”. Brokers with their recommendations. The media with their stories.

In today’s information democracy, all these constituencies affect asset demand, loyalty, premiums and advocacy. Just like assembling a winning election-day coalition, it’s all about the connections you find between what you want to build and what your target audiences want you to build for them to deliver better paths to growth. Simply put, we help companies win.

HYPERLOCAL DATA

Demographic Data, Topological Maps, Locational Attributes, Cellular Data, Geospatial Data

Data Mine

PRIMARY AUDIENCE DATA

Preferences, Wants/Needs,

Motivations, Behaviors,

Viewpoints

WEB-BASED DATA

News Trends,

Advertising, Social

Media, Clickstream Data

Data

Focusing

AI-Powered Predictive

Analytics

Insight

Applications

Multifamily &

Commercial Office

- Asset Investment / Financing

- Asset Development / Repositioning

- Asset Marketing

- Asset Leasing

- Asset Operations / Management/

Tenant Experience (Tx)

COMMERCIAL REAL ESTATE DATA

Rent, Occupancy,

Comps/Listings, New

Development, Portfolio Data

RCKRBX™ well-positions its users for future success and competitive advantage—particularly as they claim first-mover ground, proactively adapt projects to renter preferences and modern needs, and drive greater demand, loyalty, premiums, advocacy, and returns. That’s actionable intelligence.

Our Philosophy

We believe real estate assets are candidates and every day is election day. Each day, prospects vote with their preferences. Renters with a “like” or “retweet”. Brokers with their recommendations. The media with their stories.

In today’s information democracy, all these constituencies affect asset demand, loyalty, premiums and advocacy. Just like assembling a winning election-day coalition, it’s all about the connections you find between what you want to build and what your target audiences want you to build for them to deliver better paths to growth. Simply put, we help companies win.

HYPERLOCAL DATA

Demographic Data, Topological Maps, Locational Attributes, Cellular Data, Geospatial Data

Data Mine

PRIMARY AUDIENCE DATA

Preferences, Wants/Needs,

Motivations, Behaviors,

Viewpoints

WEB-BASED DATA

News Trends,

Advertising, Social

Media, Clickstream Data

Data

Focusing

AI-Powered Predictive

Analytics

Insight

Applications

Multifamily &

Commercial Office

- Asset Investment / Financing

- Asset Development / Repositioning

- Asset Marketing

- Asset Leasing

- Asset Operations / Management/

Tenant Experience (Tx)

COMMERCIAL REAL ESTATE DATA

Rent, Occupancy,

Comps/Listings, New

Development, Portfolio Data

RCKRBX™ well-positions its users for future success and competitive advantage—particularly as they claim first-mover ground, proactively adapt projects to renter preferences and modern needs, and drive greater demand, loyalty, premiums, advocacy, and returns. That’s actionable intelligence.

Our Philosophy

We believe real estate assets are candidates and every day is election day. Each day, prospects vote with their preferences. Renters with a “like” or “retweet”. Brokers with their recommendations. The media with their stories.

In today’s information democracy, all these constituencies affect asset demand, loyalty, premiums and advocacy. Just like assembling a winning election-day coalition, it’s all about the connections you find between what you want to build and what your target audiences want you to build for them to deliver better paths to growth. Simply put, we help companies win.

HYPERLOCAL DATA

Demographic Data, Topological Maps, Locational Attributes, Cellular Data, Geospatial Data

Data Mine

PRIMARY AUDIENCE DATA

Preferences, Wants/Needs,

Motivations, Behaviors,

Viewpoints

WEB-BASED DATA

News Trends,

Advertising, Social

Media, Clickstream Data

Data

Focusing

AI-Powered Predictive

Analytics

Insight

Applications

Multifamily &

Commercial Office

- Asset Investment / Financing

- Asset Development / Repositioning

- Asset Marketing

- Asset Leasing

- Asset Operations / Management/

Tenant Experience (Tx)

COMMERCIAL REAL ESTATE DATA

Rent, Occupancy,

Comps/Listings, New

Development, Portfolio Data

RCKRBX™ well-positions its users for future success and competitive advantage—particularly as they claim first-mover ground, proactively adapt projects to renter preferences and modern needs, and drive greater demand, loyalty, premiums, advocacy, and returns. That’s actionable intelligence.

RCKRBX™ Returns

Insight to drive the 5 R’s: recruitment, retention, recommendation, rent and returns

High propensity target audiences

“Know your audience.” Everyone says it, but few truly know how to do it. And, we should know, we cut our teeth in the most competitive arena there is—the political one—where one-day sales are the difference between being “in” or “out” of business.

At the core of the RCKRBX™ platform is an understanding of who your target audiences really are and what’s important to them (their decision-drivers). When paired with contextual market data, the platform enables users to exploit the collective power of audience insights and, then, relentlessly focus on the underlying triggers of demand, advocacy, premiums and loyalty.

Enhanced audience understanding

RCKRBX™ combines the expressed preferences of renter populations (both prospective and current), the unique characteristics of their environments and related behaviors to capture enhanced audience insight.

Opportunity sizing, segmentation and scoping

Stratify existing and prospective renter populations by their typologies, the motivational context behind their preferences, behaviors and decisions, and what wants/needs will drive future demand in order to meet them where they are and move where they will be.

The metrics that matter

Align “what target audiences want” with “what you deliver” to drive growth across leading indicators of asset performance that ultimately increase NOI, mitigate risk and maximize investment returns.

Actionable intelligence to drive quantifiable outcomes

Better understand (and act upon) renter populations and their preferences, the programming and positioning they value most and the premiums they are willing to pay for the places, spaces and experiences they want.

*Note, contact details required for download

Download:

Analytic Visulization

Now real estate.

Always data.

Look Forward To Future Outcomes.

Our Philosophy

WE BELIEVE REAL ESTATE ASSETS ARE CANDIDATES AND EVERY DAY IS ELECTION DAY.

Each day, prospects vote with their preferences. Renters with a “like” or “retweet”. Brokers with their recommendations. Investors with their capital. Policy makers with their issue positions. The media with their stories.

In today’s information democracy, all these constituencies affect market response (interest and engagement) and overall asset performance (demand, pace and premiums).

Just like assembling a winning election-day coalition, it’s all about the connections you find between what you want to build and what your target audiences want you to build for them to deliver better paths to growth.

Simply put, we help projects win.

Our Clients:

RCKRBX™

Leadership Team

Michael H. Broder

Chief Executive Officer

Prior to founding RCKRBX™, Michael Broder served as president and chief executive officer of Brightline Strategies from January 1999 to May 2022 when the Company was absorbed into RCKRBX™ as its bespoke research and advisory services provider. Prior to 1999, Mr. Broder served as campaign strategist and media consultant to several gubernatorial, senatorial and congressional candidates throughout the Northeast and Mid-Atlantic regions during the 1994, 1996 and 1998 election cycles.

Prior to 1994, Michael worked with Michael Deaver (former Deputy Chief of Staff to President Reagan) at Edelman Public Relations and served in the Office of Political Affairs in the first Bush Administration.

Mr. Broder’s work has received numerous awards including: Pollie, Telly, ADDY, AMR Gold Medals, and the International Television and Video Association Award of Excellence. He has lectured at the George Washington University’s undergraduate School of Political Communications and the Graduate School of Political Management.

Mr. Broder holds a B.A. in Political Communications from The George Washington University, a M.A. in Campaign Management from the Graduate School of Political Management at The George Washington University, and a J.D. from The Catholic University of America, Columbus School of Law.

James Moore

Chief Operating Officer

Prior to founding RCKRBX™ in 2021 with Michael Broder and Kevin Hudak, James Moore served as EVP & COO of Brightline Strategies. From October 1998 until October 2001, James was a Managing Director of the strategic communications firm, Chlopak, Leonard, Schechter & Associates. At CLS, Mr. Moore worked on a number of health, non-profit, education, and corporate clients including The Pew Charitable Trust’s Health-Track project, ACE Insurance, Sun Healthcare Group, Republic of Georgia Center for Economic Reforms, and the Cisco Systems sponsored NetAid. From November 1996 until October 1998, he was Senior Vice President at Edelman PR Worldwide where he specialized in Financial Communications and Public Affairs working with clients like AT&T, Credit Suisse First Boston, Pulsar, and Niagara Mohawk.

In 1996, Mr. Moore held the position of Deputy Political Director overseeing polling and opposition research for the National Republican Senatorial Committee. Prior to joining that organization he worked in the federal government as Chief of Staff for Congressman George Nethercutt from the Fifth District in Washington State.

In addition, Mr. Moore has worked on several political and issue campaigns primarily in management and media relations. Some of those campaigns include Jack Kemp’s Campaign for a New Agenda, Michael Huffington for U.S. Senate, Governor Christie Whitman of New Jersey, the Save Our Everglades initiative in Florida, an anti-gambling initiative in Idaho, and the Ukraine Independence movement.

He has developed and implemented political and communications strategies, and produced television, radio, and print advertising at every level. Further, he has extensive experience in organizing and managing successful grassroots campaigns. Mr. Moore has also worked in state government in New Jersey for the State Assembly under two Assembly Speakers. His professional background includes work for the Rollins Strategy Group and Russo Marsh, which are two political advertising and public affairs firms.

Kevin Hudak

Chief Research Officer

Prior to founding RCKRBX™ in 2021 with Michael Broder and James Moore, Mr. Hudak served as Chief Research Officer of Brightline Strategies where he developed brand, target market and audience research programs as well as designed performance tracking and business alignment analyses for many of the firm’s clients across a variety of industries.

Kevin formerly worked as a Senior Research Analyst at The Tarrance Group, one of the most respected political polling and strategy firms in the country. He has managed a variety of national, state and municipal research projects. His research portfolio includes managing surveys for political clients, public affairs and ballot initiatives as well as corporate brand and image management. Kevin’s expertise covers the full spectrum of methodology development, survey sampling, questionnaire design, data collection, analysis and providing comprehensive strategic guidance.

Kevin graduated cum laude from Dartmouth College, where he majored in Government and minored in Public Policy and Religion. Mr. Hudak is the Vice President of the Dartmouth Club of Washington, DC and has recently co-founded a non-profit to serve low-income single-parent families in New York’s Hudson Valley.

Michael Goodgold

Chief Marketing Officer

Born in Queens, Michael fell in love with the changing face of NYC. He saw the city’s architecture and design as a bookmark of the times, and was determined to make his own mark on the city.

Having graduated from FIT, Michael worked in his uncle’s fashion production company, where he became passionate about the possibilities arising from the intersection of business and purposeful design. After spending some time in Fashion, he found graphic design and communications to be a better fit. A role at a graphic design firm handling real estate clients followed – the city had come calling. Unable to ignore Manhattan’s siren song, Michael launched REA, shaking up the real estate world by delivering singularly beautiful marketing keepsakes vastly at odds with the plodding institutional fare that was the industry standard at the time.

Supported by a team of design professionals with backgrounds in branding and design, and deftly responding to new shifts and disruptions in real estate, the studio has since evolved its focus towards strategic place-making.

Michael remains fascinated by the question of what it takes to make a place that people gravitate towards. This has become a central theme at REA. Under Michael’s leadership, the studio’s unrivaled ability to help clients express the essence of a place through considered, engaging brand identities has positioned it as a conversation leader.

Caroline Nordt

Chief Technology Officer

Bio coming soon

Kris Broder

EVP Business Development

As Executive Vice President of Business Development at RCKRBX, Kris Broder leads the company's growth strategy, building key relationships with external partners and subscribers to amplify the platform’s footprint in existing markets and unlock new opportunities nationwide. She plays a central role in helping multifamily owners, developers, and investors leverage real-time demand-side data to make smarter, faster, and more aligned decisions.

Before joining RCKRBX, Kris spent nearly three decades at BECO Management, a privately held real estate firm with a portfolio of over 7 million square feet across the Mid-Atlantic and Midwest. As Executive Vice President of Brand and Workplace Experience, she oversaw strategic leasing relationships and spearheaded initiatives that redefined tenant engagement, branding, and communications—ultimately creating measurable value across BECO’s holdings.

Kris holds a B.A. in Communication from the University of Maryland and lives in Rockville, Maryland. She serves as an advisor to The Friendship Circle of Maryland, which supports families of children with special needs, and is the proud mother of Hudson and Chloe.

Samantha Rubenstein

VP Industry & Investor Relations

As VP of Industry and Investor Relations, Samantha utilizes her vast real estate and investment network to identify funding and market adoption opportunities for the RCKRBX™ platform.

She is also a co-founder of Warespace, a co-working warehouse company for small to mid-sized businesses and serves as VP of Willow Asset Management (private family office).

Samantha previously worked as a director of partnership development for BECO Management, focusing on strategic and financial partnerships. Prior to Beco Management Samantha worked as a medical advocate and medical network development for National Gaucher Foundation.

She holds a BS from NYU, an MA in educational psychology from NYU & a MSW from Columbia University.

RCKRBX™ Strategic

Advisory Board Members

Lisa Picard

Managing Partner, OxygenRE and former CEO of

Blackstone’s CRE Investment Platform (EQ Office)

Evan Regan-Levine

Chief Strategy Officer

JBG Smith

Chris Ballard

Principal

McWilliams | Ballard

Scott Gassen

CEO

Perceptive Places

Paul Schulman

Principal & COO

American Real Estate Partners (AREP)

Marnie Abramson

Principal

Lightility

Nora Dweck

Former CEO

Dweck Properties

Darren Farber

Managing Partner

Albion River

Frank Cappello

Co-Founder

New Growth Living

Matthew Huber

Faculty, Carnegie Mellon University and Co-Founder

Urban Equations Lab

Marc Schlesinger

Principal

Landmarc Asset Advisors